OSFI is Making More Changes to Guideline B-20

Can They be Positive for Canadians While Also Protecting the Banks?

On January 12, 2023, OSFI launched a public consultation of Guideline B-20 on Residential Mortgage Underwriting Practices and Procedures. OSFI has concerns about the state of the market and in their press release they state “mortgage lending risks, particularly related to debt serviceability, have increased considerably since the onset of the pandemic. These heightened near-term risks underscore the need to consider complementary measures to mitigate them.” OSFI is proposing “complementary debt serviceability measures designed to better control prudential risks arising from high consumer indebtedness. The proposed debt serviceability measures include loan-to-income (LTI) and debt-to-income (DTI) restrictions, debt service coverage restrictions, and interest rate affordability stress tests.”

Are These Changes Justified?

Our initial reaction was to wonder if this was a solution looking for a problem.

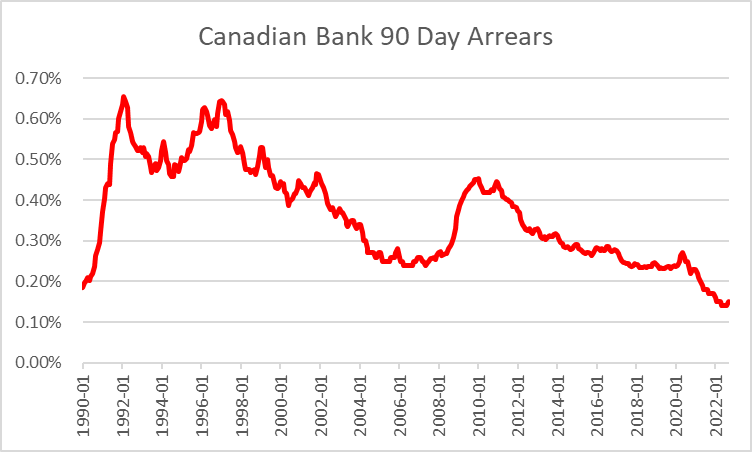

Mortgages in arrears (90+ days in arrears) at Canadian banks are at historic lows. The performance of Canadian bank residential mortgage portfolios over the past 30-plus years has been excellent. We understand the expectations that bank mortgage portfolio performance could deteriorate in the near future, but history shows that our market is already well-structured to handle a downturn. We do not see any reasons for heightened concern. Yes, Canadian households are over-levered, but Canadian bank residential mortgage portfolios have performed well through prior crises, downturns, and recessions.

While OSFI would like to keep it that way, we are not certain changes like this are needed at this time. We realize that OSFI has access to information we do not have but the timing of this could not be worse. OSFI’s priority is protecting the banks but we hope that the outcome of this round of changes is more balanced than the most often discussed government tweak to mortgage underwriting – the mortgage stress test. In an appeal for fairness, we ask OSFI to acknowledge that first-time homebuyers are not a threat to the banks or the stability of the system.

These Kind of Changes Can Have Significant Impact on Canadians

While the industry has been invited to respond to the specific areas of concern, we do anticipate some push back on OSFI’s proposals. However, once OSFI announces an intention, they tend to follow through. It is now just a question of the details.

Rather than dive into any detailed arguments on the specific proposals, we are writing this blog to suggest an emphasis should be placed on the broader outcome this will have on Canadians. Yes, the banks are important, and they are OSFI’s mandate, but the financial well being of Canadians should always be a priority.

The Canadian government has tinkered with the mortgage market in an unprecedented fashion over the past decade. Ten years ago, many Canadians new little about CMHC, the Department of Finance, OSFI and the Bank of Canada. Today, you can’t pick up a newspaper and not see articles regarding concerns these authorities have or actions they are taking in relation to the housing or mortgage markets.

We are not insiders to the discussions at the government level. From the outside it appears as though our government agencies and regulators have been i) reactionary, and ii) not coordinating among themselves.

One can argue that the timing of this round of tightening by OSFI could not be poorer. The housing market is currently in a fragile state due to higher interest rates, declining prices, rising rents, supply shortages, and inflation. The only positive influence in the market today seems to be hope. OSFI may help kill even that. We wish they could develop a practice of addressing issues like overheated markets and over-leveraged households early, rather than after the fact. For instance, concerns were raised years ago about homeowners leveraging HELOCs to make down payments on investment properties. Why not act then? Why act now after leverage has been pushed to new record highs?

Nevertheless, these changes are happening and here are some considerations we hope are taken into account that could contribute to a positive outcome:

Household leverage is at all time highs. Measures meant to address that can be helpful. For instance, the idea of constraining bank portfolio exposure to high debt-to-income customers has merit. Nevertheless, is household leverage an issue for every household? Should it be accounted for as just one big number, requiring rigid, one-size-fits-all rules? Of course not.

Often the rules imposed on us, such as the stress test, are blunt instruments. They can treat all situations the same, working to inhibit some market activities we should encourage. OSFI needs to take a nuanced approach. Identify behaviours and activities that we all want to continue. Consider how to craft new rules that get results without curbing positive outcomes;

Not all mortgage borrowers are the same. Nor do rule changes need to treat them the same. Principal residences should be a priority to a government’s housing policy. Can OSFI find a way to restrict leverage among investors, multiple property owners, and speculators while at the same time not unfairly restricting access to mortgages for first time home buyers? In our experience investor speculation is always a key driver of house price appreciation. It is hard to get good data on this but in the summer of 2022, RBC made note of the fact that they had seen a surge of investor mortgages. In a meeting with market analysts, they stated that this came at the expense of first-time home buyers (credit to betterdwelling.com for pointing this out). Clearly our market framework encourages behaviours detrimental to the core constituents – Canadian homeowners (you know - the people that own only the home that they live in).

While OSFI has a clear mandate regarding who they regulate, can they coordinate with other government bodies that are involved in housing Canadians? These underwriting changes are coming at a time of great market uncertainty and will have a significant impact on Canadians. Their actions go beyond affecting the banks they regulate.

This goes beyond OSFI’s mandate, but a coherent housing policy is needed. The air is full of concern about housing supply, household leverage, properly housing new immigrants, inflation, interest rate levels and a potential recession. Having one government body act without consideration of the broader picture can lead to deleterious impacts like we experienced with the stress test. Unfortunately, those most impacted always tend to be those at the bottom of the economic ladder or those just trying to start their climb up that ladder.

For a change, perhaps the proposed new underwriting rules could target those near the top of the ladder – such as multiple property owners, users of home equity leverage and investors. They are the ones using the combined loan plans that many are concerned about. The same combined loan plans that increase leverage and are a product almost exclusive to the banks that OSFI regulates. Repeatedly re-leveraging properties to acquire more property leads to the speculation and demand that drives housing prices to levels beyond the reach of today’s first-time homebuyers.

Priorities

Government housing policy should focus on increasing the supply of affordable housing, promoting homeownership, and addressing homelessness. Additionally, it should also focus on creating policies that promote fair housing, maintain the stability of the housing market, encourage development, and facilitate a stable rental market.

Housing policy is also not just financial policy. Household formation is not only important to the economy; it is important to Canadian community and culture. Policies addressing leverage that do not prioritize the reduction of speculative behaviour can unevenly affect young and new-to-Canada families that underpin household formation. Mortgage debt deployed for purposes of facilitating first-time homebuyers does not need to be curbed to protect the banks. To protect the banks, OSFI should be able to restrain certain activities while still allowing the market to be an opportunity for younger generations and to attend to those in need of the greatest assistance.

In our view the mortgage stress test has contributed to inequities in the Canadian housing and mortgage markets. It negatively impacts those in most need of assistance as they begin their lifelong journey to invest, settle, create a family, and contribute to their community. In addition, was it not designed to be a counter-cyclical measure, most necessary when rates were at historic lows? Now, with rates higher and market uncertainty growing, the inequities of the stress test are even more evident. Many first-time home buyers can no longer qualify while wealthy investors shrug it off, parents are draining savings to help their children with down payments, bank customers are trapped, unable to refinance with other lenders because they can’t re-qualify at today’s high, stress-tested mortgage rates. This all helps the banks though, so OSFI looks at it and concludes that all is well with the mortgage stress test. For those of us operating outside of OSFI’s orbit, they are clearly hurting the most vulnerable.

Final Word

When analysing Canadian bank exposure to the mortgage market it is easy to just see each customer as a data point. OSFI has tremendous power, as do our banks. We can all debate the merits of an oligopoly and other characteristics of the Canadian banking market, but we should all be happy that our financial markets are stable and strong. Kudos to OSFI in that regard. But with the power comes responsibility to Canadians, not just to the banks. OSFI needs to consider how each and every tweak they make affects real people. And when they do, they should try to encourage behaviours that facilitate household formation and contribute to the overall health, fairness and stability of the housing and mortgage markets. Surely, they can do this while acting to protect the banks they regulate. The two should go hand-in-hand.

Let’s make sure Canadians get housed, not hosed.

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Connect with Don on LinkedIn!