How to Manage Rising Mortgage Rates

Should Homeowners Take Interest Rate Risk?

Should mortgage borrowers be exposing themselves to interest rate risk in today’s market environment? The key factor in determining that is a borrower’s level of risk tolerance.

After a 40-year downtrend in interest rates we are seeing rates increase. This is due to the recent increase in the inflation rate. Should we be surprised if rates continue to increase? No.

Is there a material risk to you if interest rates increase? Yes, especially if you have a variable rate mortgage.

If interest rates increase, how high can they go? That is hard to know, but a little historical perspective might be helpful.

Historical Interest Rate Data

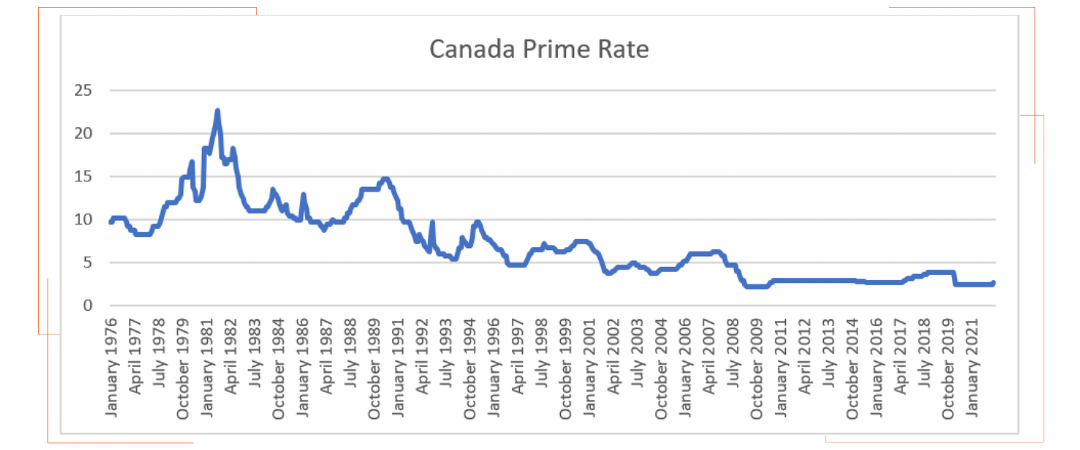

Let’s start with a historical chart of the Prime Rate in Canada. Variable rate mortgages in Canada are usually benchmarked against the Prime Rate. In other words, your variable rate mortgage has a rate equal to the Prime Rate plus or minus a margin.

The chart above, using data from the Bank of Canada, shows the Canadian Prime Rate since 1976. What stands out is the following:

There has been a long-term trend of declining rates since the early 1980’s;

The Canadian Prime Rate has been unusually low, with limited variability, for an extended period since the 2008/2009 financial crisis;

There have been periods of time in the past when the Prime Rate has increased materially in a short period of time. Examples are i) an increase of over 400 basis points (4%) from early 1994 to early 1995; ii) an increase of 300 basis points (3%) from early 1988 to early 1989, and iii) a whopping increase of 1000 basis points (10%) from late 1980 to late 1981.

The last 12 years of low rates demonstrates how central banks, like the Bank of Canada, have intervened in the markets and held rates low. The longer-term history of rates in Canada shows the significant change that can occur during a normal business cycle. Is this what we are about to experience – a market running its cycle and returning to a “normalized” level of interest rates? That is hard to predict, and we won’t attempt to do that here. What is helpful from this data is a little historical perspective that shows that the recent low level of rates is the anomaly. Are you financially prepared for this to change?

Mortgage Rate Data

Finding accurate historical mortgage data in Canada is surprisingly difficult. The best historical source is the Bank of Canada. Their data shows bank posted rates, not the actual discounted rates that almost all borrowers get, but it is still useful to evaluate the long-term trend.

We see a pattern similar to the historical Prime Rate chart. For years new homebuyers took out mortgages at rates in the double digits from the 1970’s into the 1990’s. That seems crazy to us today. Probably as crazy as a near decade of mortgage rates below 5% would have seemed back then. The moral of the story is to be mindful that there can be material and unpredictable changes in interest rates.

Why are Interest Rates Increasing?

Rates are increasing due to inflation. The main tool used by central banks to try and control inflation is raising interest rates. This has not happened in Canada for a few years, but is not an uncommon event historically. Central Banks raise rates whenever inflation rises above its target level.

Low Mortgage Rates Can Drive the Market

If you got into the housing market in the last decade or so you have done well financially. You were able to borrow at historically low interest rates and see house prices appreciate at a feverish pace. But the recent increase in rates signals a sudden shift. If you are trying to get into the housing market now the situation likely has you feeling uncertain. Will housing prices fall if rates increase? If rates increase, will I be able to qualify for a mortgage?

As with most economic matters there is no one-size-fits-all solution. While the focus now is on controlling inflation, the authorities must also have a desire to moderate the exuberance in the housing market. Governments are nibbling at the edges of the issues with programs, taxes and rule changes. However, the real driver of the overheated housing market is the unprecedented period of low interest rates that we have just experienced. We think that the Bank of Canada will raise rates in an attempt to control inflation in the near term but only to the point where they believe they won’t risk a significant housing downturn or recession. A return to high mortgage interest rates like those in the 1980’s is not likely.

Does Anyone Know Where Interest Rates Are Going?

Whether you are an existing homeowner or a prospective one, higher interest rates will impact you. Tiff Macklem, the Governor of the Bank of Canada recently said, “The economy is now in a place where moving to a more normal setting for interest rates is appropriate”. Wow, a central bank Governor just admitted that recent low interest rate levels are not normal! This sends a clear message. Rates are going up in the near term. Whether a higher “more normal setting” level of rates persists is difficult to predict, especially since the central banks will likely continue to have an overriding bias to stimulate economies and keep rates under control. Nevertheless, prepare yourself for some rate increases in the near term, but don’t get caught up in the longer-term projections from the experts. They don’t know where rates will be one or two years from now any better than you do.

What Should Mortgage Borrowers Do When Rates Are Increasing?

How increasing interest rates affect you depends on your situation. Let’s take a look at the scenarios:

If you have a fixed rate mortgage with term remaining, then you can rest easy for now. Your monthly payments will remain the same and a short-term change in interest rates won’t impact you;

If you have a fixed rate mortgage that is renewing in the next six months, you should lock-in a renewal rate with your current lender or find a deal with a new lender now. This will protect you against the near-term interest rate increases that the market is expecting;

For some variable rate mortgages, the monthly mortgage payment will stay the same when the increase in the Prime Rate is small. When this happens, more of the monthly payment will be allocated to interest and the amortization of your mortgage will slow down. It is good that your monthly payment stays the same but there is still a cost to you because the slower amortization of your mortgage increases your cost to service the mortgage over its amortization period. Note also that if the interest rate increases enough to make the required monthly interest amount larger than your existing monthly payment amount then your monthly mortgage payment will be increased to cover the additional interest amount;

If you have a variable rate mortgage, or an adjustable rate mortgage, where the monthly payment increases whenever the Prime Rate increases then you need to pay close attention to interest rates. As the Prime Rate increases, your monthly mortgage payments will also increase. If you have a mortgage like this, you need to understand what an increase in rates means to your monthly budget.

If you are looking for a new mortgage, a fixed rate mortgage will protect you against interest rate risk. If you are going to take a variable rate mortgage, either because your risk tolerance allows it or because you can only qualify for a variable rate mortgage, then make sure you understand the type of monthly payment applicable to the mortgage. If you are on a tight budget, avoid the mortgages where the payment increases whenever the Prime Rate increases.

Fair Mortgage Advice

Borrowers today who expect to be in their homes for the long term and are not looking to gamble on the direction of interest rates should take out a fixed rate mortgage. Yes, fixed rates are higher than current variable rates, but consider a higher fixed rate the cost of insurance against the negative consequences of interest rate changes.

For over a decade we have experienced an unprecedented low interest rate environment. Could rates still go lower sometime in the future? Of course, they can. In Europe interest rates went negative. We don’t believe that is an outcome that a mortgage borrower should be betting on. What we do believe is the financial risk that rates may increase and hurt you financially is greater than the potential upside from having interest rates decline further. Especially today when we are in such a protracted low-rate environment that our own central bank Governor describes as not being normal.

Today, many advisors tell their clients to take out a variable rate mortgage because rates would have to increase materially for you to end up with a rate equivalent to today’s fixed mortgage rates. That may be true, but that is why this historical perspective might be helpful. Interest rates can, and have many times in the past, risen by material amounts. A holder of a variable rate mortgage could experience serious financial stress if that were to occur. We are not saying it will, but it is a risk that you need to consider.

For us at Frank Mortgage, we think your risk tolerance is the ultimate question. First, can you afford a possible increase in your variable rate mortgage payment brought on by higher rates? For those than can afford it, taking a variable rate mortgage is not a bad choice. However, we suspect that many borrowers will face financial difficulty if their variable rate mortgage payments were to increase and if that is you, be mindful of the risk. Secondly, do you need the stress and worry of being exposed to interest rates? We prefer that our customers with a low risk tolerance can sleep well at night knowing they are not exposed to interest rate risk.

An Honest Mortgage Broker’s Perspective

Buying a home is a big financial decision. For most of us, the biggest we will ever make. But buying a home isn’t just a financial decision. When purchasing your primary residence, you are making a life decision. A place to call home, perhaps raise a family. If you want financial risk, leave it in your investment portfolio. If you do not have a high risk tolerance, secure your home with a fixed rate mortgage if you can. This will reduce the potential worry about where interest rates are moving, and the impact changes in interest rates may have on your ability to maintain the home. A fixed rate mortgage will allow you to treat your home as a home and not a financial risk.

Don Scott

Don Scott is the founder of a challenger mortgage brokerage that is focused on improving access to mortgages. We can eliminate traditional biases and market restrictions through the use of technology to deliver a mortgage experience focused on the customer. Frankly, getting a mortgage doesn't have to be stressful.

Connect with Don on LinkedIn!